Exploring the intricacies of selling a car with an outstanding loan balance, this guide offers valuable insights and practical tips for navigating this unique situation. From understanding the financial implications to exploring different selling options, this topic delves into crucial considerations for anyone looking to sell a car with an existing loan.

Providing a step-by-step breakdown of the process, this guide aims to equip readers with the knowledge needed to make informed decisions and successfully sell their car, even with an outstanding loan balance.

Factors to Consider when Selling a Car with an Outstanding Loan Balance

When selling a car that still has an outstanding loan balance, there are several important factors to take into consideration to ensure a smooth transaction and avoid financial pitfalls.: It is crucial to have a clear understanding of the exact amount owed on the loan for the car you intend to sell.

This information will help you determine the selling price needed to cover the loan balance and any additional fees associated with the sale.

Importance of Knowing the Exact Amount Owed on the Loan

- Having accurate information about the loan balance allows you to set a realistic selling price for the car.

- Knowing the exact amount owed helps in negotiating with potential buyers and ensures transparency in the sale.

- It prevents surprises or last-minute financial setbacks that may arise during the selling process.

Impact of the Car’s Current Market Value on Selling with a Loan Balance

- The current market value of the car plays a significant role in determining if selling with an outstanding loan balance is feasible.

- If the market value is lower than the loan balance, you may need to cover the remaining amount out of pocket to close the sale.

- Higher market value can make it easier to sell the car without incurring additional costs to pay off the loan.

Tips on How to Determine if Selling the Car is Financially Viable

- Compare the current market value of the car to the outstanding loan balance to assess the financial feasibility of the sale.

- Consider factors such as depreciation, mileage, and overall condition of the car to determine its resale value accurately.

- Consult with the lender to understand any prepayment penalties or fees associated with paying off the loan early.

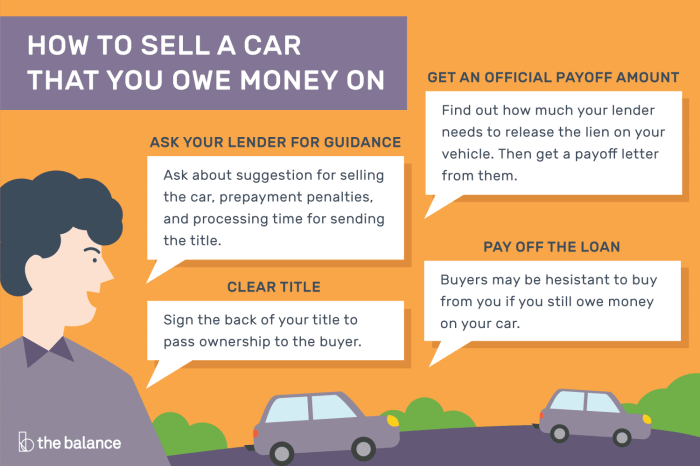

Steps to Take Before Selling a Car with an Outstanding Loan Balance

Before selling a car that still has an outstanding loan balance, there are several important steps that need to be taken to ensure a smooth transaction and legal compliance.

Obtaining the Payoff Amount from the Lender

Before you can sell a car with an outstanding loan balance, you will need to contact your lender to obtain the payoff amount. This amount represents the total sum required to pay off the remaining balance on the loan. The payoff amount may include the remaining principal balance, accrued interest, and any penalties for early repayment.

Transferring the Title to the New Owner

Once you have the payoff amount from the lender, you will need to work with them to facilitate the transfer of the title to the new owner. The title is a legal document that proves ownership of the vehicle and must be properly transferred to the new owner to complete the sale.

Make sure to follow the specific procedures Artikeld by your state's Department of Motor Vehicles to ensure a valid transfer of ownership.

Preparing the Necessary Documentation for the Sale

Before finalizing the sale of a car with an outstanding loan balance, it is essential to gather all the necessary documentation. This may include the vehicle title, bill of sale, maintenance records, loan documents, and any other relevant paperwork. Having these documents organized and readily available will help streamline the selling process and provide transparency to the buyer.

Options for Selling a Car with an Outstanding Loan Balance

When it comes to selling a car with an outstanding loan balance, there are several options available to you. Let's explore these options to help you make an informed decision.

Compare selling the car for the loan amount versus selling for market value

One option you have is to sell the car for the loan amount

Discuss the option of trading in the car at a dealership

Another option is to trade in the car at a dealership. This involves selling your car to the dealership and using the proceeds towards paying off the remaining loan balance. While this may be a convenient option, keep in mind that you may not get the best price for your car compared to selling it privately.

Explain the process of selling the car privately and handling the loan payoff

If you decide to sell the car privately, you will need to find a buyer willing to purchase the car for its market value. Once you have a buyer, you will need to work with your lender to handle the loan payoff.

This typically involves paying off the remaining loan balance using the proceeds from the sale.

Strategies for Paying Off the Loan before Selling

When selling a car with an outstanding loan balance, it's essential to consider strategies for paying off the loan to streamline the selling process and ensure a smooth transaction.

Ways to Pay Off the Loan Balance

- Use Savings: Consider using your savings to pay off the remaining loan balance. This can help clear the debt and increase the chances of selling the car quickly.

- Get a Personal Loan: Another option is to take out a personal loan to cover the outstanding balance. Make sure to compare interest rates and terms to find the best option.

- Trade-In for a Cheaper Car: If possible, trade in your current car for a cheaper model. The difference in value can be used to pay off the existing loan.

Benefits of Paying Off the Loan Early

- Clear Title: Paying off the loan early ensures that you have a clear title to the vehicle, making the selling process much easier.

- Higher Selling Price: A car without any outstanding loan balance can fetch a higher selling price compared to one with debt attached to it.

- Improved Negotiation Power: Having a paid-off loan gives you more leverage when negotiating with potential buyers, as it eliminates any complications related to the loan.

Tips on Negotiating with the Lender for an Early Payoff

- Communicate Early: Reach out to your lender as soon as possible to discuss the possibility of an early payoff. They may offer incentives or discounts for early repayment.

- Ask for a Payoff Quote: Request a payoff quote from the lender, which includes the total amount needed to clear the debt. This will help you plan your finances accordingly.

- Negotiate Terms: Don't hesitate to negotiate with the lender for more favorable terms, such as a reduced payoff amount or waiver of certain fees.

Final Summary

In conclusion, selling a car with an outstanding loan balance requires careful planning and consideration. By following the steps Artikeld in this guide and exploring the various options available, sellers can navigate this complex process with confidence and ease. Whether opting to pay off the loan early or exploring different selling strategies, sellers can make informed choices to achieve a successful sale.

Question Bank

What is the importance of knowing the exact amount owed on the loan?

Knowing the exact amount owed on the loan is crucial as it helps sellers determine the total financial obligation they need to settle before selling the car.

What are the benefits of paying off the loan early?

Paying off the loan early can help sellers avoid additional interest payments and potentially increase the resale value of the car.

Is trading in the car at a dealership a viable option?

Trading in the car at a dealership can be convenient, but sellers should be aware that they might not get the best value compared to selling privately.