Delving into the realm of Average Auto Insurance Quote by State in 2025, readers are invited to explore the intriguing landscape of insurance costs across different states. This article promises to provide an insightful journey through the factors influencing quotes, trends in costs, and predictions for the future, ensuring a comprehensive view of the subject matter.

Highlighting the top states with the highest quotes, analyzing trends, and comparing urban versus rural costs, this piece is set to offer a well-rounded perspective on the dynamics of auto insurance pricing.

State Variations in Auto Insurance Quotes

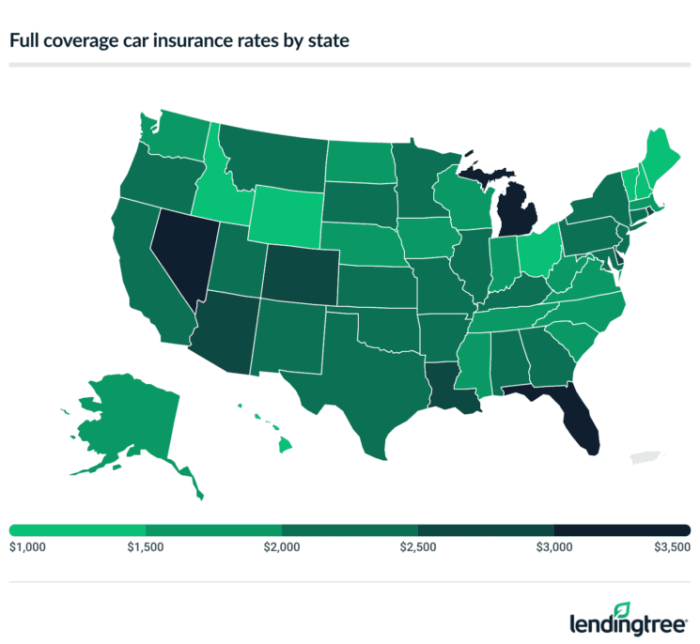

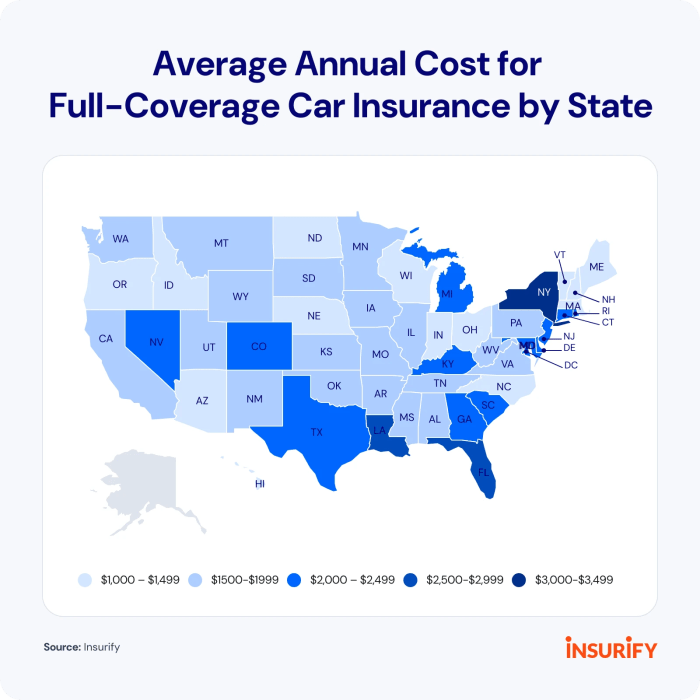

In 2025, auto insurance quotes vary significantly across different states due to various factors impacting pricing.

Top Three States with the Highest Average Auto Insurance Quotes

- 1. Louisiana: Louisiana consistently ranks as one of the states with the highest auto insurance rates due to factors such as high accident rates, uninsured drivers, and costly litigation.

- 2. Michigan: Michigan's unique no-fault insurance system contributes to its high auto insurance rates, along with expensive medical costs and high levels of auto theft.

- 3. Florida: Florida also experiences high auto insurance rates primarily due to its large population, high traffic congestion, and exposure to natural disasters.

Factors Contributing to Differences in Quotes Between States

- 1. State Regulations: Each state has its own insurance regulations and minimum coverage requirements, affecting pricing.

- 2. Population Density: States with higher population densities tend to have more traffic congestion and accidents, leading to higher insurance rates.

- 3. Weather and Natural Disasters: States prone to severe weather events or natural disasters often have higher insurance rates to account for increased risk.

Trends in Auto Insurance Costs

As we look at the trend of average auto insurance quotes across states from 2020 to 2025, we can observe significant fluctuations that have impacted drivers nationwide. Let's delve into the reasons behind these changes and how economic factors play a crucial role in determining auto insurance costs on a state level.

Fluctuations in Average Auto Insurance Quotes

From 2020 to 2025, auto insurance costs have shown variations across states, with some experiencing notable increases while others have seen decreases. These fluctuations can be attributed to several factors, including changes in driving patterns, state regulations, and insurance market dynamics.

- States with a higher frequency of accidents or insurance claims tend to have higher auto insurance premiums. This could be due to increased risk factors and the likelihood of filing claims.

- Legislative changes at the state level, such as reforms in insurance laws or regulations, can impact insurance costs. For example, states that implement stricter regulations on insurance companies may see higher premiums to offset potential losses.

- Economic conditions play a significant role in determining auto insurance costs. States with a strong economy and low unemployment rates may experience lower insurance premiums, as individuals are perceived as lower risk to insure.

Impact of Economic Factors on Auto Insurance Costs

Economic factors such as GDP growth, inflation rates, and unemployment levels can influence auto insurance costs in various ways. States with a booming economy and stable employment rates may see a decrease in insurance premiums, as drivers are considered less likely to default on payments or engage in risky behavior.

It's essential for drivers to stay informed about these trends and factors that affect auto insurance costs to make informed decisions when selecting coverage.

Factors Influencing Auto Insurance Quotes

Insurance companies take various factors into account when determining auto insurance quotes. These factors can significantly impact the cost of premiums for drivers. Let's explore some key elements that influence auto insurance pricing.

Driving Record

One of the most critical factors that insurers consider is the driver's record. A clean driving history with no accidents or traffic violations usually results in lower insurance premiums. On the other hand, a history of accidents or speeding tickets can lead to higher rates.

Vehicle Type and Usage

The type of vehicle you drive and how you use it also play a role in determining insurance costs. Sports cars or luxury vehicles typically come with higher premiums due to increased risk of theft or expensive repairs. Moreover, if you use your car for business purposes, you may face higher rates.

Location and State Laws

Where you live and local regulations can impact insurance pricing. Urban areas with higher rates of accidents or theft may result in higher premiums. Additionally, state laws regarding minimum coverage requirements can influence the cost of insurance in each state.

Age and Gender

Younger drivers, especially teenagers, tend to face higher insurance rates due to their lack of driving experience. Gender can also be a factor, with young male drivers typically facing higher premiums than young female drivers. However, this gap tends to narrow as drivers age.

Credit Score

Insurance companies often consider an individual's credit score when determining auto insurance rates. A higher credit score is generally associated with lower risk and can lead to lower premiums, while a lower credit score may result in higher costs.

Comparison of Urban vs. Rural Auto Insurance Quotes

In the realm of auto insurance, the location where a vehicle is primarily used and parked can significantly impact the cost of insurance coverage. Let's delve into the disparity between urban and rural auto insurance quotes and explore the factors contributing to these differences.

Contrast in Average Auto Insurance Quotes

In urban areas, where population density is high and traffic congestion is common, auto insurance quotes tend to be higher compared to rural areas. The risk of accidents, theft, vandalism, and other perils is elevated in urban settings, leading to increased insurance premiums to mitigate these risks effectively.

Factors Influencing Insurance Costs Based on Location

The disparity in insurance costs between urban and rural areas can be attributed to various factors, such as:

- Crime Rates: Urban areas often experience higher crime rates, including vehicle theft and vandalism, which can drive up insurance premiums.

- Traffic Congestion: The likelihood of accidents occurring in congested urban areas is greater, influencing insurance costs.

- Population Density: Higher population density in urban settings means more vehicles on the road, increasing the risk of accidents and insurance claims.

Impact of Urbanization on Insurance Premiums

Urbanization plays a crucial role in determining auto insurance premiums, as it directly affects the frequency and severity of claims. With more vehicles sharing the road in urban areas, insurers face a higher probability of having to pay out claims, leading to higher premiums for urban drivers.

Additionally, the cost of living and repair services in urban centers can also contribute to increased insurance rates.

Future Predictions for Auto Insurance Quotes

As we look ahead beyond 2025, the landscape of auto insurance quotes is likely to undergo significant changes influenced by various factors. Let's delve into some future predictions for auto insurance quotes.

Potential Disruptive Factors

Disruptive factors could reshape the insurance industry's pricing models, leading to fluctuations in auto insurance quotes. Some potential disruptive factors include:

- Rise of autonomous vehicles: With the increasing adoption of autonomous vehicles, the risk landscape for auto insurers may change, impacting how quotes are calculated.

- Climate change-related events: As the frequency and severity of climate change-related events like hurricanes and wildfires increase, insurers may need to adjust their pricing models to account for these risks.

- Advancements in telematics: Continued advancements in telematics technology may enable insurers to offer more personalized quotes based on real-time driving data.

Innovative Approaches for Personalized Quotes

To stay competitive and meet evolving customer needs, insurers may explore innovative approaches to offer more personalized and competitive quotes. Some of these approaches could include:

- Usage-based insurance: Insurers may increasingly offer usage-based insurance policies that tailor premiums to individual driving habits and patterns.

- Data analytics and AI: Leveraging data analytics and artificial intelligence, insurers can refine their risk assessment models and provide more accurate quotes.

- Packaged insurance products: Offering bundled insurance products that cater to specific customer segments or lifestyles could lead to more tailored and competitive quotes.

Ending Remarks

In conclusion, the intricate web of factors shaping auto insurance quotes by state in 2025 unveils a complex tapestry of economic, technological, and demographic influences. As we gaze into the crystal ball of future predictions, one thing remains certain – the landscape of auto insurance pricing is ever-evolving, paving the way for innovative solutions and personalized offerings.

FAQ Summary

Why do auto insurance quotes vary between states?

Insurance quotes differ based on various factors such as state regulations, population density, and economic conditions.

How do demographic factors impact auto insurance costs?

Demographic factors like age, gender, and marital status can influence insurance pricing by state.

What disruptive factors could reshape insurance pricing models in the future?

Technological advancements, changes in driving habits, and new regulations could potentially alter how insurance quotes are determined.